Understanding Your Monthly Mortgage Payment

A mortgage payment calculator online is a free tool that estimates your monthly house payment based on your loan details. Here’s what you need to know:

| What You Can Calculate | What You Need to Enter |

|---|---|

| Monthly principal & interest | Home price |

| Property taxes | Down payment amount |

| Homeowners insurance | Loan term (years) |

| PMI (if applicable) | Interest rate |

| HOA fees (if applicable) | Property tax rate |

| Total monthly payment | Insurance costs |

Using an online mortgage calculator helps you understand exactly what you’ll pay each month before committing to a home purchase. This is crucial for first-time homebuyers who need to budget accurately.

The 30-year fixed-rate mortgage is the most common term in the United States, representing 70% to 90% of all mortgages. Most borrowers aim for a 20% down payment to avoid paying private mortgage insurance (PMI), which typically costs between 0.3% and 1.9% of the loan amount annually.

Mark Hamrick, a senior economic analyst, advises: “Many prospective homeowners are tempted to ‘stretch’ when buying… Being conservative and cautious with a home purchase is advisable.”

A good mortgage calculator breaks down your payment into its component parts, showing you exactly where your money goes each month. This transparency helps you make informed decisions about what you can truly afford.

The monthly payment is just one piece of the homebuying puzzle. You’ll also want to consider closing costs (typically 2% to 5% of the purchase price) and ongoing maintenance (about 1% of the home’s value annually).

Top Features of a Mortgage Payment Calculator Online

When you’re diving into the home-buying process, a reliable mortgage payment calculator online can be your best friend. Think of it as your financial crystal ball – showing you what your future payments might look like before you sign on the dotted line.

The best calculators do more than just crunch numbers – they help you understand what you’re getting into. Most homebuyers I talk with spend about 15-20 minutes playing with different mortgage scenarios before they feel comfortable with their options. A well-designed calculator makes this exploration fun rather than frustrating.

What makes a mortgage calculator truly helpful? It’s the combination of being easy to use while still giving you the complete picture. The most valuable calculators show you a comprehensive payment breakdown of your PITI (principal, interest, taxes, and insurance), offer amortization schedules so you can visualize how your balance decreases over time, and provide adjustable inputs that let you test “what if” scenarios.

Great calculators are also mobile responsive (because who isn’t house-hunting on their phone these days?) and include visual elements like charts and graphs that make complex financial concepts easier to grasp.

What to look for in a tool

Not all mortgage calculators are created equal. Some are bare-bones while others give you the full financial picture. When you’re comparing tools, here’s what to look for:

First, input flexibility is crucial. You’ll want a calculator that lets you adjust everything from home price and down payment to interest rate and loan term. The best ones let you input your down payment as both a percentage and dollar amount – super helpful when you’re working with a specific savings amount.

Look for calculators that include tax and insurance estimates. Property taxes typically run around 1.1% of your property’s value, while homeowners insurance usually costs less than 1% annually. Having these estimates built in saves you from hunting down this information separately.

A PMI toggle is another must-have feature. If you’re putting down less than 20% on a conventional loan, you’ll be paying private mortgage insurance until you reach that equity threshold. Good calculators show you this cost and – even better – when you can expect it to disappear.

I love calculators that offer biweekly payment options. This simple change – making 26 half-payments instead of 12 full payments each year – can save you thousands in interest and shave years off your mortgage. Seeing the comparison can be eye-opening!

Finally, amortization charts are incredibly valuable. As Joe, a first-time buyer in San Francisco, told me: “I was shocked to see how much of my early payments went to interest rather than principal. The amortization chart really opened my eyes to how mortgages actually work.”

These visual aids help you understand the long-term impact of your mortgage decisions – sometimes revealing that a slightly higher monthly payment might save you tens of thousands over the life of your loan.

Reliable and Educational: Your Guide to Real Estate’s Calculator

Here at Your Guide to Real Estate, we’ve built our mortgage payment calculator online with a simple philosophy: it should teach you, not just calculate for you. We want you to understand not just what your monthly payment will be, but why it’s structured that way and how different choices affect what you’ll pay.

Our calculator stands out because it does more than crunch numbers – it explains them too. We automatically fill in property tax estimates based on where you’re looking to buy, but you can easily adjust these if you have more specific information about local rates.

Want to see the difference between a 15-year and 30-year mortgage? Our side-by-side comparison shows you exactly how much more you’ll pay each month with a shorter term – and how much less you’ll pay in interest over the life of your loan. Unlike most calculators that limit you to just these two options, we include 10, 20, and 25-year terms too, because we know one size doesn’t fit all when it comes to mortgages.

“I never realized how much money I could save by going with a 20-year mortgage instead of the standard 30-year option,” says Jamie, a recent first-time buyer. “The calculator showed me I’d be saving over $60,000 in interest with just a modest increase in my monthly payment.”

We’ve also added clear explanations about escrow accounts – that mysterious system where your lender collects property taxes and insurance as part of your monthly payment. Many first-time buyers find this concept puzzling, so we break it down in plain English.

Not sure how much house you can realistically afford? Our calculator links directly to affordability resources that help you determine a sensible price range based on your income and existing debts. For even more in-depth information, check out our beginner’s guide to home loans.

Strengths & ideal users

Our mortgage payment calculator online particularly shines for certain types of homebuyers. If you’re buying your first home, you’ll appreciate our plain-language tooltips that explain terms like “amortization” and “private mortgage insurance” without the confusing jargon.

If you’re the careful type who likes to plan conservatively, you’ll love how we apply the 28/36 rule (housing costs shouldn’t exceed 28% of your gross income, and total debt payments shouldn’t exceed 36%). This helps ensure you’re not taking on more house than your budget can comfortably handle.

For the deeply curious who want to understand the “why” behind every number, we’ve added detailed explanations for each component of your mortgage payment, with links to more resources if you want to dive deeper.

Sarah, who recently used our calculator while house-hunting, told us: “What I loved most was how the calculator didn’t just give me cold, hard numbers. It explained what they meant for my financial future. The comparison between different loan terms helped me decide on a 20-year mortgage instead of the standard 30-year, which will save me over $50,000 in interest.”

Ready to learn more about mortgage basics? Visit our comprehensive guide to home loans for everything you need to know before signing on the dotted line.

Fast Pre-Qualification and Rate Shopping

One of the most valuable aspects of using a mortgage payment calculator online is the ability to quickly pre-qualify for different loan scenarios and shop for the best rates without affecting your credit score.

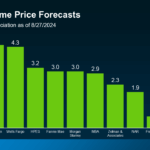

Today’s sophisticated mortgage calculators do more than just crunch numbers – they connect you to real-time rate data, showing you current market conditions rather than yesterday’s outdated examples. This means you can make decisions based on what’s happening right now in the mortgage world.

When you’ve played around with the numbers and found a scenario that works for your budget, most calculators will guide you toward your next steps. They’ll typically offer clear pathways to getting pre-qualified with a lender, starting a formal application, or connecting with a mortgage loan officer who can answer your specific questions.

It’s worth noting that most calculators assume you’re purchasing a single-family home as your primary residence. If you’re eyeing an investment property, shopping for a vacation home, or considering a multi-family dwelling, you’ll likely face different interest rates and down payment requirements than what the standard calculator shows.

Did you know that borrowers who compare at least three different lenders save an average of $300 per year on their mortgage payments? That’s not pocket change! Using an online calculator to pre-screen your options before formally applying can save you both time and money in the long run. Think of it as doing your homework before the big test.

Downsides to note

While mortgage payment calculators online are incredibly useful tools, they’re not perfect crystal balls. Here are a few limitations you should keep in mind:

Most calculators focus solely on your monthly payment but conveniently forget about closing costs. These expenses typically run 2% to 5% of your purchase price and can significantly impact how much cash you need to bring to the closing table. It’s like budgeting for a vacation but forgetting about airfare!

Basic calculators tend to showcase only conventional loan options, leaving out FHA, VA, USDA, and jumbo loan scenarios. These specialized loans have their own unique requirements and costs that might not show up in standard calculations, potentially hiding better options for your situation.

Be aware of potential advertiser bias when using free tools. Some calculators are designed to funnel users toward specific lenders or loan products. They’re helpful, yes, but remember they may have an agenda behind those helpful numbers.

As Maria, a recent first-time homebuyer, shared with us: “The calculator showed I could afford a $400,000 home, but it didn’t account for the $16,000 in closing costs I needed at signing. I wish I’d known to budget for that from the beginning. It was quite a shock!”

Want to become a savvier mortgage shopper? Visit our comprehensive mortgage shopping guide for insider tips and strategies to help you steer the lending landscape with confidence.

Advanced Customization for Power Users

If you’ve mastered the basics of mortgage calculations, you’re ready to explore the deeper capabilities that advanced mortgage payment calculators online offer. These sophisticated tools take you well beyond simple payment estimates into the field of detailed financial planning.

Think of these advanced calculators as your personal mortgage laboratory, where you can experiment with various scenarios to optimize your homeownership journey. They allow you to see exactly how different decisions might play out over the life of your loan.

With an advanced calculator, you can model extra payments to see their long-term impact. Adding just $100 monthly to a standard $300,000 mortgage at 4% interest doesn’t just feel good—it actually saves over $26,000 in interest and helps you own your home 2.5 years sooner. That’s real money back in your pocket!

For condo buyers or those considering planned communities, the ability to include HOA fees in your calculations provides a much more accurate picture of your true monthly housing costs. These fees can sometimes be substantial, so accounting for them upfront prevents budget surprises later.

One of the most valuable features is the PMI drop-date calculation. Instead of wondering when you’ll reach that magical 20% equity mark to eliminate private mortgage insurance, these tools show you the exact date. For many homeowners, removing PMI can save hundreds of dollars monthly—money better spent building equity or saving for other goals.

The biweekly payment scheduling option is another powerful feature. By making half your mortgage payment every two weeks instead of a full payment monthly, you’ll make 26 half-payments annually—effectively creating a 13th monthly payment each year. This simple change can potentially shave years off your mortgage term without dramatically affecting your monthly budget.

Perhaps the most visually satisfying feature is the interactive graphical charts that update in real-time as you adjust your inputs. There’s something deeply satisfying about watching that principal line creep upward faster as you test different payment strategies. These visual tools help transform abstract numbers into clear financial paths.

The best advanced calculators even account for the inevitable increases in recurring costs over time. Property taxes rarely stay flat year after year, and the same goes for insurance and HOA fees. By factoring in realistic annual percentage increases, you get a much more accurate long-term projection of your housing expenses.

Why power-users love it

Financial-savvy homebuyers don’t just appreciate these tools—they rely on them for making strategic decisions about their largest investment.

The early payoff modeling features allow you to test different strategies for mortgage acceleration. Should you make extra monthly payments, annual lump sums from bonuses, or both? The calculator shows you exactly which approach gives you the biggest bang for your buck.

“I recommend advanced mortgage calculators to all my clients,” shares Michael, a financial advisor. “Being able to toggle between different scenarios and immediately see the long-term impact helps them make decisions that align with their broader financial goals, not just their monthly budget.”

The refinance planning capabilities are particularly valuable in fluctuating rate environments. Instead of guessing whether refinancing makes sense, these tools provide concrete break-even analysis showing exactly how long it takes to recoup closing costs through monthly savings. This feature alone can save homeowners thousands by preventing ill-timed refinances or helping them seize genuinely beneficial opportunities.

These advanced tools transform mortgage management from a passive monthly payment into an active strategy for building wealth and achieving financial freedom. They put the power of professional-grade financial analysis in your hands, making complex decisions clearer and more accessible.

For more detailed information about comparing different mortgage options and making the most of these advanced features, visit our mortgage comparison guide.

Extra-Payment & Amortization Specialist Features

One of the most powerful aspects of a comprehensive mortgage payment calculator online is the ability to model different payment strategies and see their impact on your loan’s amortization schedule.

The best calculators don’t just tell you what your payment will be—they help you explore ways to save thousands of dollars over the life of your loan. When you’re looking at these specialized tools, keep an eye out for these game-changing features:

Lump-sum entry options give you the freedom to see what happens when you apply that year-end bonus or tax refund directly to your principal. Imagine watching years disappear from your mortgage timeline with just a few clicks!

Loan scenario saving capabilities let you compare different strategies side-by-side, making it easier to decide whether making extra payments or refinancing makes more sense for your situation.

Printable PDF reports provide detailed amortization schedules you can review offline or share with your financial advisor. There’s something satisfying about seeing your debt shrink month by month on paper.

Shareable URLs make it simple to send specific scenarios to your partner, family members, or co-borrowers. No more trying to explain complex financial scenarios over the phone—just share your exact calculations with a link.

According to financial research, making biweekly mortgage payments instead of monthly can help buyers save tens of thousands of dollars and pay off their loan years earlier. This simple switch works because you end up making 26 half-payments annually (equivalent to 13 full payments) rather than 12 monthly payments.

Best strategies to try

When you’re playing with the numbers in your amortization calculator, it’s worth testing a few proven money-saving approaches that real homeowners swear by.

The biweekly payment plan is perhaps the simplest yet most effective strategy. If your monthly payment is $1,000, switching to biweekly payments of $500 results in 26 payments per year ($13,000 vs $12,000), essentially sneaking in an extra payment annually. On a typical 30-year mortgage, this small change can slice about 4-5 years off your term—without feeling much different in your day-to-day budget.

Applying a one-time bonus directly to your principal can create ripple effects throughout the life of your loan. For instance, using a $5,000 work bonus to pay down a $300,000 mortgage in year 5 can save over $10,000 in interest over time. The calculator lets you see this magic happen before your eyes.

Many homeowners find success with the rounding up payments approach. It’s psychologically easier to pay $1,300 instead of $1,243—and those extra dollars go straight to principal. This painless strategy can shave months off your mortgage with minimal impact on your monthly cash flow.

Smart homeowners regularly perform a refinance check using these calculators. You can compare your current mortgage with potential refinance options, factoring in closing costs (typically 2-5% of the loan amount) to determine if and when you’ll break even on the deal.

“I used the extra payment calculator to see what would happen if I applied my $3,000 tax refund to my mortgage principal each year,” shares one homeowner. “I was amazed to find this simple strategy would help me pay off my 30-year mortgage in just 22 years, saving over $60,000 in interest.”

These calculations aren’t just academic exercises—they’re powerful planning tools that can literally save you tens of thousands of dollars. For more detailed strategies on accelerating your mortgage payoff, check out our first-time homebuyers toolkit.

FAQ & Pro Tips for Using a Mortgage Payment Calculator Online

Let’s face it – mortgage calculators can seem intimidating at first glance, but they’re actually your best friends when it comes to planning your home purchase! We’ve gathered the most common questions we hear from future homeowners about mortgage payment calculators online, along with some insider tips to help you get the most out of these handy tools.

What makes a mortgage payment calculator online accurate?

The difference between a rough estimate and a truly useful calculation comes down to three key factors:

The first is input precision. It’s like baking – the more exact your measurements, the better your results! When you input specific figures for your home price, down payment amount, interest rate, and other costs, you’ll get a much more reliable estimate of your monthly payment.

Local tax information also makes a huge difference. Did you know the average American pays about 1.1% of their property’s value in taxes each year? But this can swing wildly from 0.3% to over 2% depending on where you live. Using your actual local tax rate rather than a generic estimate can prevent payment surprises down the road.

Your credit score plays a significant role too. Most basic calculators don’t account for how your credit score affects your interest rate. For context, every 20-point drop in your credit score might mean paying 0.25% to 0.5% more in interest – which adds up to thousands over the life of your loan.

“I always tell my clients to overwrite the default values with their own numbers,” says mortgage specialist Phillip Cannon. “This is especially important for property taxes and insurance, which can vary dramatically even between neighboring towns.”

Can I trust a free mortgage payment calculator online?

Free calculators can be incredibly valuable tools, but it’s important to understand their limitations.

These tools provide estimates only, not guaranteed figures. Even the best calculator can’t account for every variable that lenders consider when creating your actual loan offer. As Cannon wisely notes, “This mortgage calculator has only been designed to give a useful general indication of costs. It’s important you always get a specific quote from the lender and double-check the price yourself before acting on the information.”

Always verify calculator results with actual loan offers from lenders. They’ll have the most current rates and fees based on your specific financial situation, including factors that online calculators might miss.

Pay attention to those disclaimers that appear on calculator pages too. They typically state that results don’t constitute loan approval or financing guarantees. These disclaimers exist for a reason – to help you understand the tool’s limitations.

Here’s a pro tip that’s saved many of our readers from confusion: use multiple calculators and compare their results. If you get significantly different numbers, that’s your cue to investigate further before making any big decisions.

How can I use a mortgage payment calculator online to lower my payment?

This is where mortgage calculators really shine – helping you find strategies to reduce your monthly burden and potentially save thousands!

Try modeling extra principal payments to see their impact. Even small additional payments toward principal, especially early in your loan term, can significantly reduce your total interest and potentially shorten your loan. It’s amazing how adding just $100 extra per month can make such a difference over time.

Use the calculator to run a term comparison between different loan lengths. While a 15-year mortgage will have higher monthly payments than a 30-year, it typically saves more than 50% on total interest paid. Seeing these numbers side by side can help you decide if the higher payment is worth the substantial long-term savings.

Don’t underestimate the power of rate shopping! Even a seemingly tiny difference in interest rates can have a major impact on your wallet. On a $300,000 loan, the difference between 4% and 4.5% is about $86 per month – or over $30,000 throughout a 30-year term.

Financial advisor Sarah Jenkins offers this valuable insight: “Apply extra payments early in the loan term to maximize interest savings. The impact of extra payments diminishes as you get further into your mortgage, so starting early gives you the biggest bang for your buck.”

For more information about how mortgage rates are determined, check out the Consumer Financial Protection Bureau’s guide to understanding mortgage rates.

For even more strategies on optimizing your mortgage and getting the best possible deal, be sure to check out our comprehensive first-time buyer toolkit.

Conclusion

Finding the right mortgage payment calculator online can transform your home buying journey from a confusing maze into a clear path forward. These powerful tools help you understand not just what you’ll pay each month, but how your payments work over time and what strategies might save you money.

At Your Guide to Real Estate, we believe that informed homebuyers make better decisions. That’s why we’ve created comprehensive resources to guide you through every step of the mortgage process, from initial calculations to final closing.

Remember these key takeaways as you steer your mortgage journey: The best calculators include all components of your payment—principal, interest, taxes, insurance, PMI, and HOA fees. This complete picture helps you budget accurately and avoid surprises down the road.

Making that 20% down payment might seem daunting, but it’s worth considering since it helps you avoid PMI, which typically adds between 0.3% and 1.9% of your loan amount annually. That’s money that could be building equity instead!

I’ve seen countless homeowners benefit from simple payment strategies like biweekly payments or adding a little extra to their principal each month. These approaches can save tens of thousands in interest and help you own your home years sooner than planned.

Always remember that calculator results are estimates—they’re incredibly useful for planning, but always verify with actual lenders before making final decisions. Market conditions and your personal financial situation will influence your exact terms.

For long-term financial health, keep the 28/36 rule in mind: try to keep your housing costs below 28% of your gross income and total debt payments below 36%. This balanced approach helps ensure your mortgage improves your life rather than becoming a burden.

As you continue your homebuying journey, I encourage you to explore our other resources, including our first-time homebuyers toolkit for comprehensive guidance on navigating the entire process.

With the right tools and knowledge at your fingertips, you’ll be well-equipped to find a mortgage that fits your budget today while supporting your financial goals for tomorrow. The perfect home is waiting for you—and now you know exactly how to calculate what it will cost!

Happy house hunting from all of us at Your Guide to Real Estate!